Build a Fintech application easily

Plaid has been making lots of headlines both good and bad. For investors who put in $310 million in Plaid so far, Visa’s $5.3 Billion acquisition announcement of Plaid definitely must be very good news. 😉

In any case, for those who haven’t heard of Plaid or know what they do, here is an elevator pitch.

Plaid offers infrastructure for Fintech companies as a service.

Think of them as middleman between banks and Fintech startups. If you used a fintech app such as Coinbase, Robinhood etc., you’ve been served by Plaid. The core concept is that most of the functionality that you experience in a bank’s branch when you walk in there and talk to a banker, Plaid takes that functionality, wraps it in a set of APIs and delivers that to you as an (app) consumer wherever you want to go with your app. Confused?

Well, let’s say you’re using an app to interact with your bank account – be that to pay a friend, apply for a loan, make an investment, transfer some funds etc., Plaid builds the infrastructure that allows that app to connect to the bank account on the backend.

While Plaid goes directly to the Fintech products and are a B2B provider they want to be consumer oriented. Their mission is to make handling money easier for everyone especially as it gets into the hands of consumers. Plaid states they spend lot of time on building an ecosystem, enabling developers and creating a Fintech landscape such that anyone can create any Financial product which then leads to more financial products for consumers, which they think is a win.

Just in the U.S., there are about 15,000 financial institutions building all sorts of financial products and services. For a developer to integrate with all those banks each with its own methodologies is a nightmare. Plaid focuses on deep partnerships with these financial institutions and builds a layer that makes it easier for anyone to integrate with any of these financial institutions and build Fintech products more easily.

How does Plaid differentiate from the likes of Yodlee?

Well, for Plaid data access is just the basic foundation in what they do. They focus quite a lot in building services on top of that foundation, and so the first step is in providing an amazing developer experience. They want anyone building a Fintech product to go end-to-end very easily.

Then they also create a lot of solutions on top of it. Take for example, lending solutions. They offer products that can do better analytics on top of transaction data and help better understand cash flows, allow someone to better understand the way that they might make a loan to a consumer and how that consumer might repay. Data access is really just foundational to what they do.

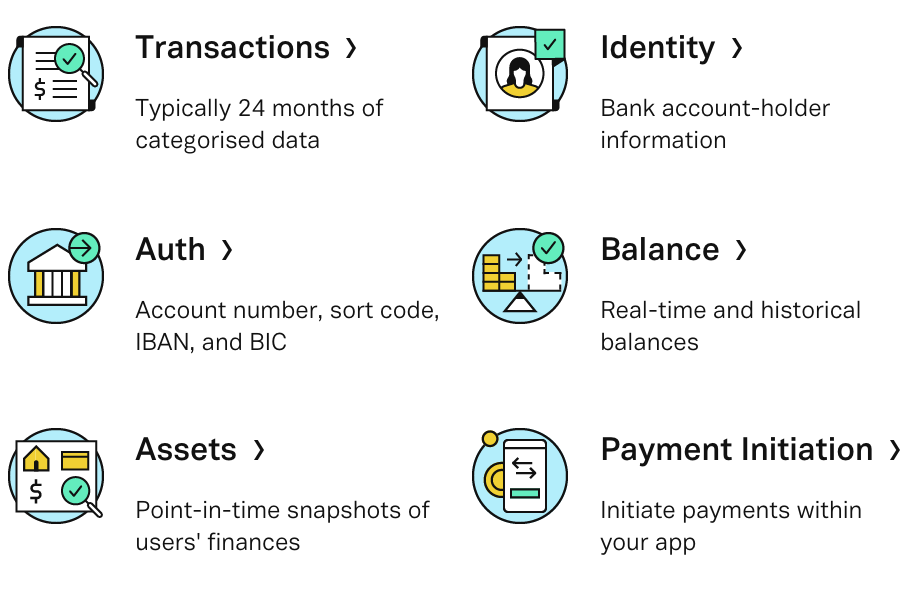

Here are some more use cases:

User Reviews

Be the first to review “Build a Fintech application easily” Cancel reply

You must be logged in to post a review.

Refund Policy

Be honest and have a legitimate reason if you think you really have a valid reason to qualify for a refund. I changed my mind is not a valid reason. It ain't easy to refund a spouse, is it? Please commit only if you are seriously interested.

User Questions & Answers

There are none yet! Be the first one and get the top spot.

There are no reviews yet.